Best Cheap Car Insurance (quotes from $94/mo)

Top 8 Cheapest Car Insurance Companies

There are hundreds of car insurance companies across the United States, offering a variety of coverage options at different price points. To ensure wide accessibility, the following list focuses on providers that offer coverage in all 50 states.

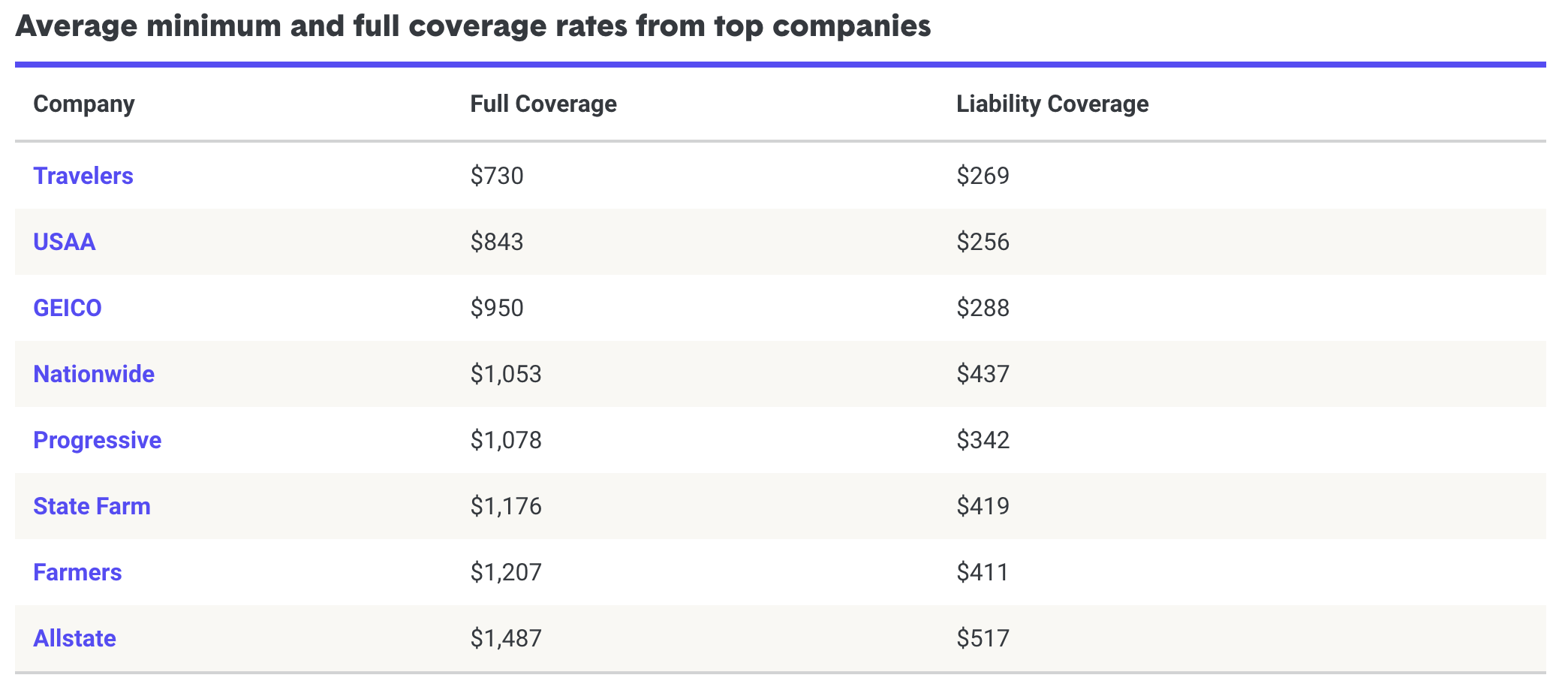

Based on average minimum and full coverage rates, here are the top 8 cheapest car insurance companies:

- USAA

USAA consistently ranks as one of the most affordable car insurance providers, offering highly competitive rates for both minimum and full coverage. However, USAA is only available to military members, veterans, and their families.

- Travelers

Travelers is known for its comprehensive coverage options and discounts, making it one of the most budget-friendly insurers available nationwide. It offers tailored policies to suit various needs while maintaining affordability.

- Geico

With its extensive discount options and low base rates, Geico is a popular choice for affordable auto insurance. It’s a top contender for drivers seeking quality coverage at a reasonable cost.

- State Farm

State Farm provides competitive rates alongside a robust network of agents. Known for its reliable customer service and discounts, it’s an excellent choice for drivers across the country.

- Progressive

Progressive is another nationwide provider offering affordable rates, especially for drivers who take advantage of its Snapshot program. It caters to a wide range of budgets without compromising on coverage options.

- Nationwide

True to its name, Nationwide offers coverage across all 50 states with affordable rates and a variety of discounts. Its strong reputation for customer satisfaction adds value for policyholders.

- Liberty Mutual

Liberty Mutual provides flexible coverage options at competitive prices. Its unique add-ons, like accident forgiveness, make it a cost-effective choice for diverse driving needs.

- Farmers

Though slightly higher than the other companies on this list, Farmers offers solid coverage options along with multiple discounts that can help reduce premiums for qualifying drivers.

By comparing quotes from these providers, you can find the policy that best fits your budget and coverage requirements while ensuring nationwide availability.

How to Find the Best Cheap Auto Insurance

Shopping for car insurance can feel overwhelming, especially when you're looking for quality coverage that fits within your budget. However, with the right approach and knowledge, you can find affordable auto insurance without compromising on protection. Below are some tips and strategies to help you secure the best cheap auto insurance:

1. Compare Multiple Insurers

Not all insurance companies are created equal, and rates vary widely depending on the provider. Comparing quotes from multiple insurers is one of the most effective ways to ensure you're getting the best deal. Online comparison tools can simplify this process and help you review coverage options side by side.

2. Understand Coverage Needs

Before choosing a policy, consider your specific coverage needs. Do you need comprehensive and collision coverage, or will basic liability suffice? Evaluating your driving habits, vehicle value, and financial situation can help you identify the type of coverage that's right for you, avoiding unnecessary add-ons.

3. Look for Discounts

Many insurance companies offer discounts that can significantly lower your premium. Common discounts include those for safe driving, bundling home and auto insurance, being a good student, or installing anti-theft devices in your vehicle. Be sure to ask insurers about available discounts to maximize your savings.

4. Maintain a Good Driving Record

A clean driving record is one of the easiest ways to qualify for lower rates. Insurance companies reward drivers who pose less risk, so avoiding accidents, traffic violations, and claims can help you secure more affordable premiums.

5. Consider Raising Your Deductible

Opting for a higher deductible can lower your monthly premium costs. However, make sure you can afford the out-of-pocket expense if you do need to file a claim. This strategy can be especially helpful if you're a safe driver with a lower likelihood of accidents.

6. Shop Around Regularly

Auto insurance rates change over time, and the policy that was the best deal a few years ago may not still be the most affordable option. Shopping around annually or at the end of your current policy term ensures you're not missing out on better deals.

7. Check Customer Reviews

While price is important, customer service and claims handling are critical factors to consider when selecting an insurer. Reading reviews and researching an insurance company's reputation can save you from potential hassles in the future.

By following these strategies, you can take control of the car insurance shopping process and find a policy that aligns with your budget and coverage needs. Affordable auto insurance is within reach—it just requires a bit of research, comparison, and smart decision-making.